Genuine bequest designers like Rustomjee Gather, Godrej Properties, House of Abhinandan Lodha, and others have propelled plotted advancement ventures close Mumbai Several genuine Estate engineers over Maharashtra have propelled plotted improvement and estate ventures over the state, particularly in zones such as Lonavala, Khandala close Pune, Dapoli in Konkan locale of Maharashtra, Alibag in Raigad locale close Mumbai, House in Palghar area close Mumbai, Igatpuri, Kasara Ghat close Nashik and Karjat close Mumbai.

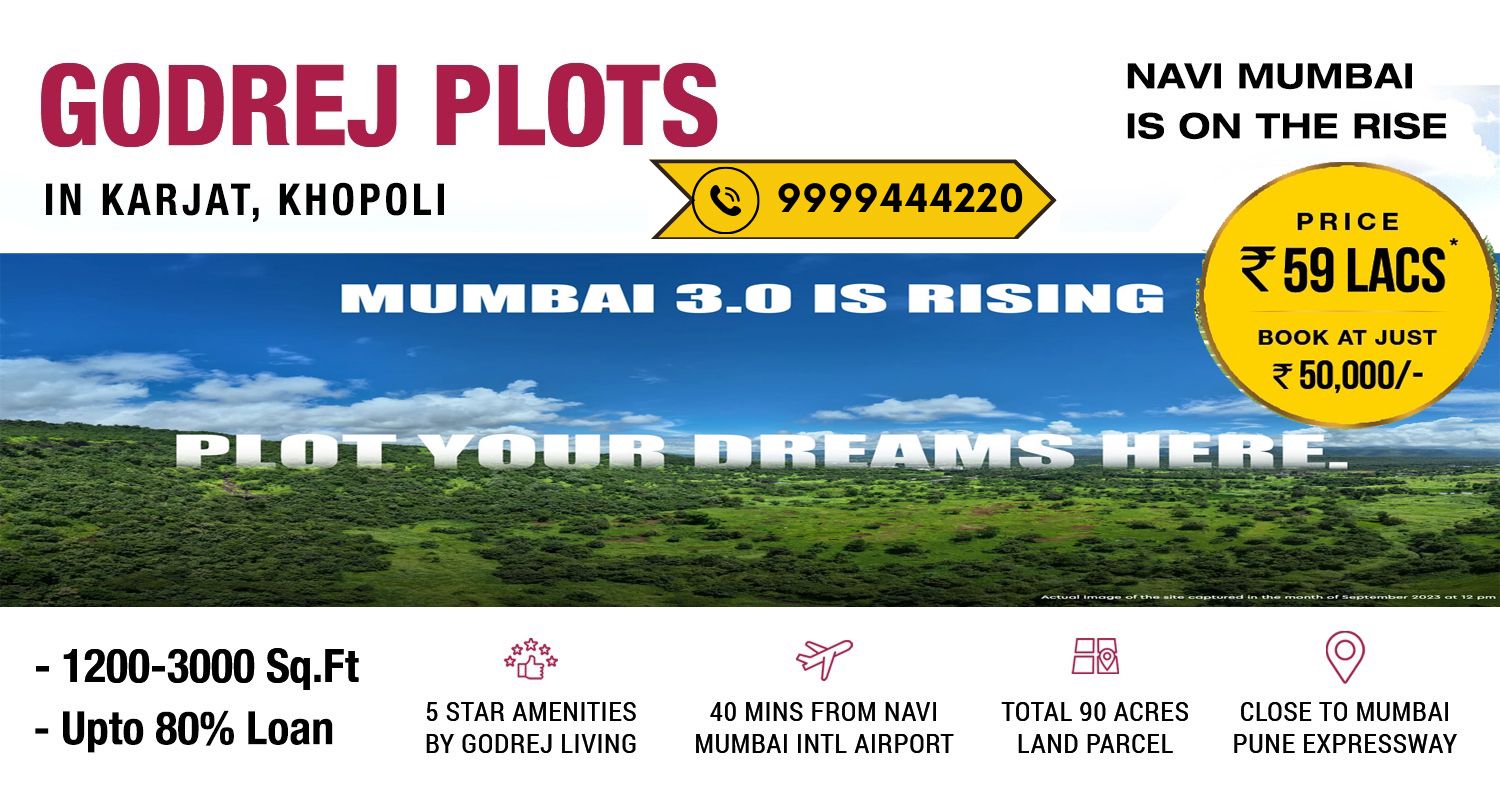

These incorporate Rustomjee Bunch, Mahindra Lifespaces, Godrej Properties, Wadhwa, House of Abhinandan Lodha (HoABL), Arihant Superstructures among others. Godrej Properties has propelled a extend named Godrej Woodside Estate on Karjat Khopoli Street close Panvel where it is offering plots measured between 1,200 sq ft to over 3,000 sq ft in the cost extend of ₹54 lakh to over ₹1.35 crore.

Rustomjee Gather as of late reported its to begin with plotted venture in Kasara Ghat- a three hours drive from Mumbai with the dispatch of 462 estate plots beginning at ₹59 lakh. Wadhwa Magnolia by Wadhwa Bunch has too propelled a plotted venture in Panvel, Navi Mumbai having final exchange cost of per sq ft cost of ₹6,500, as of June 2024. Mahindra Meridian by Mahindra Lifespaces Gather has propelled 26 plotted units at a cost of ₹2,060 per sq ft (final exchange cost as of June 2024) in Alibag close Mumbai.

Mumbai-based Kalpataru Restricted has propelled 240 units at a cost of ₹1,817 per sq ft (final exchange cost as of June 2024) in Karjat- a moment domestic goal close Mumbai. HoABL has propelled 1,086 units at a cost of ₹1,596 per sq ft (final exchange cost as of June 2024) in Neral- foothills of Matheran close Karjat, concurring to the information of CRE Matrix.

Godrej Plots Karjat Raigad area that covers zones such as Panvel, Karjat, Khalapur, Khopoli, has seen dispatches of 66 plotted advancement ventures comprising 7,024 units and 36 estate ventures with 981 units since 2019, concurring to the information of given by CRE Lattice, a genuine domain information examination platform.

Majority of buyers who have contributed in plotted improvement and estate ventures are in the age of 25 to 45 a long time. These are fundamentally from Mumbai, Thane, Pune, Hyderabad, Palghar, Nashik, Nagpur, Jaipur and Jodhpur, information shared by CRE Network showed.

Prices of these plotted improvements coming up in and around Mumbai begin at ₹50 lakh and can go up to as tall as ₹2 crore if not more, said nearby brokers.

Also Examined: Mumbai genuine bequest: Mahindra and Mahindra Ltd offers 20.5 sections of land arrive in Kandivali region for ₹210 crore

There has been a surge in plotted improvement ventures post Covid-19

Infrastructure advancement over cities has moreover driven to the development of this section. The roll-on-roll-off (RoRo) administrations interfacing Mandwa close Alibaug with South Mumbai and the Atal Setu – a 22 km long ocean bridge interfacing Mumbai and Navi Mumbai – have driven to a few plotted advancement ventures getting propelled in ranges such as Alibag and Dapoli.

The Mumbai-Pune Expressway Enlargement extend has empowered speculators to put their cash into moment homes in Lonavala and Khandala, said experts.

What ought to financial specialists keep in intellect some time recently contributing in plotted improvement or estate projects?

People interested in contributing in plotted advancements or estates ought to check the possession title of the arrive. They ought to too check if the arrive is rural or non-agricultural.

“While contributing in arrive, one ought to get it the contrast between agrarian arrive or non- rural arrive. Godrej Woodside Estate We require to be doubly beyond any doubt around the proprietorship title of the venture. In reality, speculators ought to get the legitimate due tirelessness of the venture done some time recently contributing their cash. Records such as property card, 7/12 extricate, property assess bills, water association bills ought to be confirmed some time recently marking on the dabbed line,” said Aditya Zantye, a Mumbai-based chartered bookkeeper who hones in MahaRERA, a genuine bequest administrative body.

“Along with due tirelessness of the property title, one moreover needs to keep in intellect the charge risk that may collect to an speculator putting in cash in a plotted advancement. As of now, non-resident Indians (NRI)s cannot contribute in rural arrive due to limitations beneath the Remote Trade Administration Act (FEMA). Something else, one ought to check the sum due as stamp obligation, enlistment charge, property assess and water charge. Brief term and long term capital pick up assess (LTCG) risk may moreover emerge if the financial specialist chooses to offer the property,” said Zantye.

When it comes to LTCG, one needs to keep in intellect that charge risk is the same as that of offering a house or office space. For illustration, if you acquired a arrive allocate for ₹50 lakh and sold it afterward for ₹1 crore, the capital pick up here is of ₹50 lakh, said Zantye. Godrej Woodside Estate Plots Mumbai will provide you the higher appreciation in future.

Budget 2024-25 had proposed to lower the long-term capital picks up charge on genuine domain to 12.5% from 20% but without the indexation advantage. Be that as it may, this was afterward revised. The government’s reexamined budget declaration permits citizens to choose between a 12.5% Long-Term Capital Picks up (LTCG) charge rate without indexation and a 20% rate with indexation, for properties acquired some time recently July 23, 2024

How much appreciation can speculators anticipate from a plot?

According to specialists, speculators can anticipate sensible returns from a plotted advancement asset.

“Prices of plotted improvement ventures have acknowledged 4X in the final six a long time. We anticipate this slant to proceed over the another few a long time. Framework improvements in MMR have driven to expanded intrigued among financial specialists, particularly for zones such as Manor-Palghar, and Kasara-Igatpuri,” said Abhishek Kiran Gupta, CEO and Originator CRE Matrix.

“Cities like Pune, Bengaluru, Hyderabad and indeed NCR have seen impressive intrigued in plotted advancement projects,” he said.

“Land has acknowledged on normal in India by 18-20% on a per annum premise though appreciation for private properties drifts around 10-12% on an normal over India. The pushed on framework advancement – where metro cities are being associated to tier-2 and level 3 cities and towns – has guaranteed this development,” said Ritesh Mehta, Senior Executive, and Head (North and West), private administrations and designer activity, JLL India, a genuine bequest consultancy firm.